Fed Rate Cut: What It Means for NH & MA Mortgage Rates

The Federal Reserve announced a rate cut yesterday, and homeowners across New Hampshire and Massachusetts are asking the same question: What does this mean for mortgage interest rates? While the Fed funds rate doesn’t directly set mortgage rates, it does influence them — and this move is creating opportunities for both homebuyers and homeowners considering a refinance.

How the Fed Rate Cut Impacts NH and MA Mortgage Rates

When the Fed lowers the benchmark rate, it often reduces borrowing costs across the financial system. That means NH and MA mortgage rates may trend lower in the weeks ahead. Even a small drop can make a big difference for affordability.

- Homebuyers may see lower monthly payments, giving them more buying power in competitive markets like Boston, Worcester, Manchester, and Portsmouth.

- Homeowners who already have a mortgage may now benefit from refinancing to secure a lower interest rate.

Refinance Savings in NH and Massachusetts

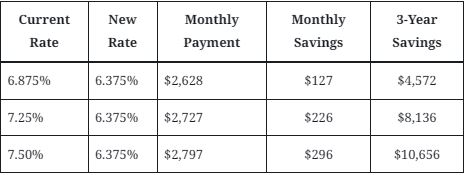

If you purchased your home in the last few years at a higher rate, refinancing could save you hundreds per month. Here’s an example of potential savings for a $400,000 loan balance:

📊 These numbers show how even a small rate drop can add up over time. A quick check with a mortgage refinance calculator can show your personal savings potential.

For homeowners considering a Massachusetts mortgage refinance, the higher loan sizes often seen in metro areas mean the savings can be even more substantial.

Why It’s a Good Time to Buy in NH and MA

Lower rates not only help homeowners refinance but also open doors for new buyers.

- If you’re planning to buy a home in NH, reduced mortgage interest rates New Hampshire can improve affordability in cities like Concord and Nashua.

- For those looking to buy a home in Massachusetts, even a quarter-point rate drop can offset the impact of higher prices in areas like Boston and Cambridge.

Locking in a lower rate now could help you secure a better long-term payment, especially if home prices continue to rise.

Current NH and MA Mortgage Rates

Mortgage interest rates don’t move overnight with Fed cuts, but the trend is clear: the Fed’s decision is putting downward pressure on borrowing costs. Both mortgage interest rates New Hampshire and mortgage interest rates Massachusetts are now more favorable than they’ve been in months.

Ready to Explore Your Options?

Whether you’re a homeowner in New Hampshire or Massachusetts thinking about refinancing, or a homebuyer deciding if now is the right time to purchase, this Fed rate cut has created new opportunities. Everyone’s situation is unique, and your savings depend on your loan balance, credit, and long-term goals.

If you’d like to see how today’s rates could work for you, I’d be happy to walk you through your options and show you the potential savings. Even a quick conversation can give you clarity on whether refinancing or buying now makes sense for your finances and future plans.

If you’d like help running the numbers, getting Pre-Approved or exploring whether refinancing makes sense for your situation, Contact us & I’d be happy to walk you through your options.

Know someone who might enjoy this article? Feel free to share it with them.