Homebuyers 2025: Why the Market Is Heating Up

Buyer demand is rising again in 2025 as lower mortgage rates bring more people back into the housing market. Learn what this means if you are buying or selling a home and how refinancing could save you money.

Introduction: A Shifting Housing Market in 2025

After a few years of uncertainty in the housing market, things are beginning to change in 2025. Lower mortgage rates are sparking fresh activity, and more buyers are actively returning to the market. Whether you are planning to purchase your first home, move into something new, or considering refinancing, understanding these trends can help you make smarter decisions.

Buyer Demand is Heating Up in 2025

The housing market is showing fresh signs of activity in 2025. After months of hesitation from buyers, lower mortgage rates are encouraging more people to start home shopping again. This increase in demand is good news for both homebuyers and homeowners.

What Rising Demand Means for Homebuyers

If you are looking to purchase a home this year, you may start to notice more competition. When more buyers are active in the market, homes tend to sell more quickly and often receive multiple offers. That means preparation is key.

Here are a few steps to give yourself an advantage as a buyer:

- Secure a mortgage pre-approval so you are ready to make an offer right away.

- Use a mortgage calculator to know your budget and stay within a comfortable monthly payment range.

- Be flexible with location, price range, and home features to expand your options.

Even though mortgage rates have improved, affordability still matters. The more prepared you are, the easier it will be to find the right home without feeling rushed or overextended.

What It Means for Homeowners Thinking About Selling

For homeowners, the rise in buyer activity creates an opportunity. More demand usually translates into:

- Homes selling faster once they are listed.

- A better chance of receiving multiple offers.

- Stronger negotiating power on price and terms.

If you have been waiting to list your home, the current environment may give you an edge. Even if you are not ready to sell right away, keeping an eye on buyer demand can help you time your move wisely.

Why Homeowners Should Also Consider Refinancing

It is not only buyers who benefit when mortgage rates drop. Many homeowners are finding that refinancing now can lower their monthly payment, shorten their loan term, or free up cash for other financial goals. Even a small rate improvement can add up to significant long-term savings.

Should You Act Now?

The key takeaway is that the housing market is becoming more active again. Buyers who prepare early will be ready to compete when the right home becomes available. Homeowners who decide to sell now can take advantage of increased demand, while those who refinance can lock in savings before rates change again.

Next Steps for Buyers and Homeowners

Whether you are planning to buy your first home, move into something new, or explore refinancing options, the most important step is to get professional guidance tailored to your situation.

📞 Contact me today to discuss your options and find out how you can take advantage of today’s housing market.

Bonus: How Much Could You Save by Refinancing?

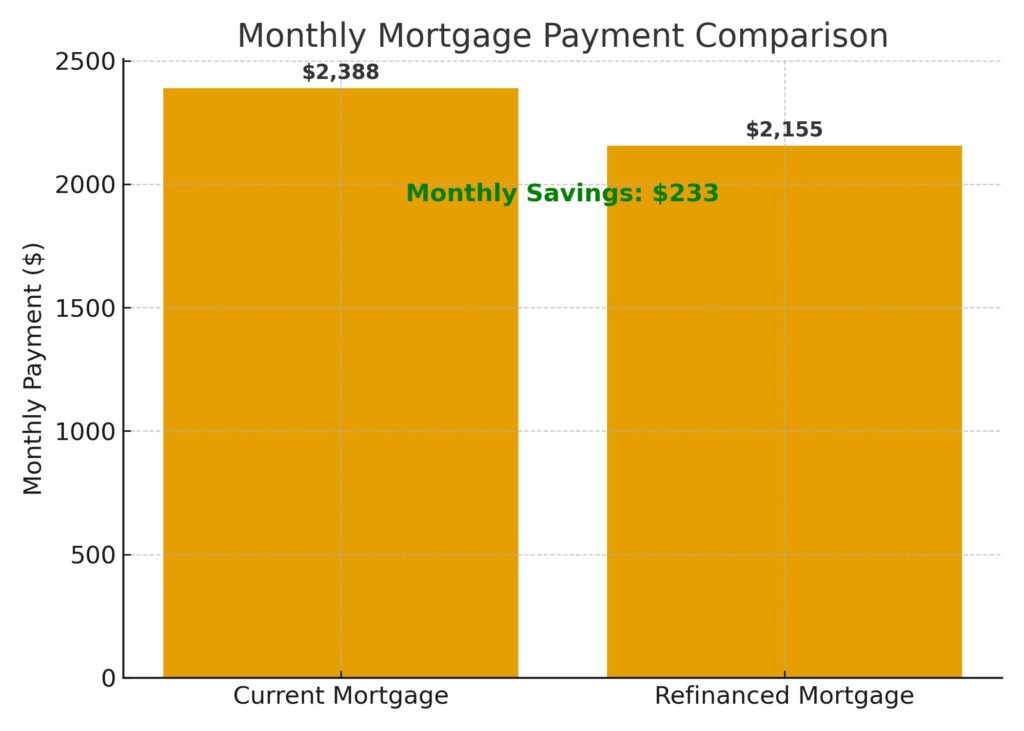

To see how refinancing can make a real difference, consider this example:

- A homeowner currently owes $350,000 on a 30-year fixed-rate mortgage at 7.25%.

- Their monthly principal and interest payment is about $2,390.

- By refinancing into a new 30-year loan at 6.25%, their monthly payment drops to around $2,155.

That is a savings of $235 every month or more than $2,800 per year. Over the life of the loan, this homeowner could save tens of thousands of dollars.

If you’d like help running the numbers, getting Pre-Approved or exploring whether refinancing makes sense for your situation, Contact us & I’d be happy to walk you through your options.

Know someone who might enjoy this article? Feel free to share it with them.