What is a DSCR Mortgage?

A DSCR or Debt Service Coverage Ratio loan is a mortgage loan in which a borrower uses the properties projected or actual cash flow to qualify, instead of their own income. A great option that is commonly used for investment properties, read more below.

What is a DSCR Mortgage Loan?

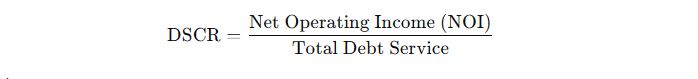

A DSCR loan refers to a Debt Service Coverage Ratio loan, which is a type of loan where the borrower’s ability to repay the loan is assessed based on the ratio of the properties net operating income (NOI) to its debt service obligations. The Debt Service Coverage Ratio (DSCR) is a financial metric used to evaluate a properties income to cover its debt payments, including both principal and interest. DSCR loans can use either the current or projected income off of form 1007 in these calculations to help qualify a property and borrower.

DSCR Calculation

- Net Operating Income (NOI) is the income generated from the property or business after operating expenses (excluding taxes, interest, depreciation, and amortization).

- Debt Service is the total amount of all debt payments including principal and interest as well as taxes & insurance due during a given period.

Common DSCR thresholds:

- A DSCR of 1.0 means the property has just enough income to cover their debt service.

- A DSCR greater than 1.0 indicates that the property has more income than the debt payments, making the loan less risky.

- A DSCR less than 1.0 means the property does not have enough income to cover debt service, which could be a warning sign for lenders.

Generally most lenders will be more likely to accept a DSCR of 1.0 or more as it shows that the subject property will generate enough revenue to cover its liabilities. As an investor you can also use a properties DSCR to help in your determination of whether any given property is a good investment based on your goals.

How is NOI and Debt Service determined:

Most lenders determine the Net operating income (NOI) and debt service for the DSCR calculation by using a few different methods.

- Form 1007: Also known as a rent schedule, Form 1007 shows a breakdown of the subject properties current rental revenue per unit as well as rental revenue from comparable properties. A lender can also use this form to find the projected rental values per unit if the unit is not currently rented and use it in the DSCR calculation.

- Other documents: These can include current mortgage statements, tax bills, insurance invoices , loan estimate and any other documents that accurately reflect the subject properties’ liabilities.

- Business Documents: Lenders may use financial documents commonly used by businesses to help determine a properties NOI and Debt Service. Such as Profit & Loss Statements, Balance Sheets and cash flow statements.

Who can benefit from a DSCR Loan:

DSCR loans have many benefits, especially for investors looking to purchase or refinance properties. The following are some common scenarios in which a borrower would opt for a DSCR loan instead of Conventional or government backed financing such as FHA or VA.

- An individual investor or business who wishes to purchase or refinance real estate without using their personal or business income to qualify.

- An individual who owns other properties used for income and does not have a traditional form of income like w2 employment.

- An individual who would like to purchase a property but does not have sufficient income to qualify for a conventional or government backed mortgage.

Other Key Features of DSCR Loans:

- Down Payment Requirements

- DSCR mortgages typically require a down payment of between 20% to 30% depending on the borrower eligibility and properties DSCR, though some loans may require more, depending on the lender. DSCR loans do not require Private Mortgage Insurance (PMI), unlike with conventional financing.

- Interest Rates

- With a DSCR loan much like a conventional mortgage, you can choose between a fixed-rate mortgage, where the interest rate remains the same throughout the life of the loan, or an adjustable-rate mortgage (ARM), where the rate can fluctuate after an initial fixed period.

- Loan Limits

- Unlike Conventional loans DSCR loans do not follow Fannie Mae and Freddie Mac guidelines. Also known as a Non-Qm or Non-Qualifying Mortgage, DSCR loan guidelines vary & more emphasis is placed on the lenders individual guidelines.

- Qualification Criteria

- To qualify for a conventional mortgage, you’ll still need a good credit score but the lender has more flexibility to determine whether they deem you eligible. Because DSCR loans do not use personal or business income to qualify; there is no debt-to-income ratio (DTI) used to qualify.

- No Government Backing

- Since DSCR loans are not insured or guaranteed by the government or Fannie Mae/Freddie Mac, lenders take on more risk. This means that interest rates can be higher than they are on Conventional or government backed loans.

How to Apply for a DSCR Mortgage

The process of applying for a DSCR mortgage is very similar to other mortgages, Here’s a basic overview of the steps involved:

- Talk with your Lender: Just like with other mortgage types before you start shopping for a home or investment property, it’s a good idea to speak with your lender & fill out an application to review your options; before looking at properties.

- Provide Documentation: Be prepared to provide documentation such as: bank statements, tax returns, and credit history to your lender.

- Find a property: We recommend working with a Real Estate Agent familiar with investment properties & DSCR loans to help you through the purchasing process, as it can be more involved upfront than when using more traditional financing. If you’re in need of a good Realtor let us know & we can help you find one that fits your needs.

- Close on your Loan: Once you’re under contract, you’ll go through the closing process, where you’ll sign the final paperwork and take possession of your new home or investment property.

Conclusion:

A DSCR Mortgage is a great option for those looking to purchase a home or investment property by using the propertie’s cash flow and not their own individual or business income to qualify. Though not as straightforward as a Conventional mortgage, we’re here as real estate investment specialists to help you understand and get the best loan option for you and your individual needs.

Mortgages can be confusing which is why we’re here to help find a solution tailored to you and provide 24/7 support for all of your financing needs.

Reach out to us any time to learn more about our loan options, We’re always available & here to provide expert guidance and support for you!

Know someone who might enjoy this article? Feel free to share it with them.